FINANCIAL FORECAST 2021

- Bill Hansen

- on Jun, 18, 2016

- 1 Comment.

NEWS BEFORE THE NEWS

2021 FINANCIAL FORECAST

Stock prices are a neat reflection of public sentiment. In the rise of business there is exuberance, in the fall there is despair. Public confidence, spending, and investment are high as the market goes up. Pessimism, hoarding, and conservative business practices set in when the market turns down.

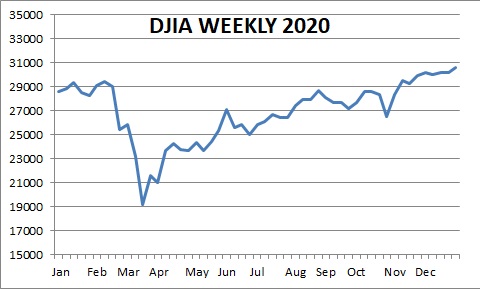

The stock market did exceptionally well in 2020 in spite of a fast and scary sell-off in March due to Covid-19 pandemic fears. The DJIA rose 7.3% to a new record high. The NASDAQ index rose 44% due to the heavy reliance on the internet during the pandemic.

Last Year’s Prediction

Astrologers are anxiously anticipating the spectacular triple conjunction between Jupiter, Saturn, and Pluto during five peak periods in 2020. The five exact conjunctions peak in January, April, June, November and December. The Jupiter/Saturn conjunction is historically significant as its recurring pattern every twenty years imprints a new generation of societal, political, and economic conditions. The twelve year Jupiter/Pluto conjunction implies financial reversal and wild, extreme swings in the market. It can indicate a collapsing market or one that is severely impacted and in need of extensive reform and rebuilding.

The market will receive three blows: three rapid gut punches and then a final knockout blow.

The Fibonacci number sequence since 1932 is nearing an end. This numerical ratio is found throughout the natural world as a structural relationship in bee hives, leaves, snowflakes, etc. The sequence also correlates with major economic downturns such as 1987, 2000, 2008, 2013 (false), 2016, and 2018. The years 2018-2020 constitute the last three consecutive years before the series repeats.

The first punch to the stock market was in March 2018 when stocks (DJIA) lost 3,000 points from the January high. The high point in January was not surpassed until the market’s historic rise in September. This brief high, only a little over 100 points above January, was dashed by a second punch in October’s rapid sell-off that pushing the Dow down about 2000 points and nearly wiped out all of the year’s gains. A correction blow is expected near May 2019 followed by a stock rise into December and January before a third knock-out blow in early 2020.

THIS YEAR’S PREDICTION

The stock market should do exceptionally well as the Covid-19 epidemic winds down. Now that vaccines are being administered the economic horizon looks bright. There is, however, trouble ahead in terms of a bubble bursting or some calamity that unnerves investors. Expect the market to rise to a peak in April or May 2021. Caution flags should be flying in the summer as a steep sell-off is indicated between (or near) July and September. The market may then resume its upward momentum and finish the year with a net gain. This could be a sharp dive similar to but not at deep as the one in 2020.

The forecast ahead involves an analysis of ten key factors.

(1) {} Sunspots indicate the highest bull markets and the lowest bear ones. 2008 was a year of sunspot minimum, so a lowest bear market was indicated – hence, the Great Recession. December 2014 marks the last sunspot super high. The NOAA projects the next sunspot low in 2019. This will be the approximate time of the next sunspot super market low. This prediction was met in 2020. Sunspots are now slowly rising in number.

(2) {-} All of the planetary aspects except one point to a major market collapse!

{+} Jupiter-Saturn indicates a high point in the market near December 2018 (correct: October 2018), and two more potential highs near June and August before a recession/depression in 2020. According to this indicator the market begins to revive in 2021.

{-} Jupiter-Uranus points to a financial crisis in the latter half of 2020 and first half of 2021.

{-} The Jupiter-Neptune cycle is primarily an inflation indicator but beginning around October 2020 it points to a slide toward a financial crisis bottoming near April 2022.

{-} Jupiter-Pluto pinpoints a drop after September 2018 (correct) continuing to a low in 2020 (correct). A drop near April or September 2021 is possible with a huge drop scheduled near Apr/May 2022.

{-} February, June, and December are nudge points in 2021 for a sharp decline that extends into early 2022.

{} Saturn-Pluto denotes a low in 2020 (correct).

(3) {} Saturn-Neptune is primarily a deflation cycle reflecting modest deflation starting in 2009. A major deflationary period was reached in 2015-2016! Note the lower oil prices in 2015-16 and 2020.

(4) {+} When there are an above average number of eclipses in one year (six or seven) the market tends to be disrupted. Only four eclipses grace 2021.

(5) {-} This is the most important market indicator. Major financial down turns have correlated remarkably well with Mars-Jupiter-Saturn aspects. A brief history illustrates: The three-planet cycle correctly pointed to a correction near August and December 2007. The next Mars-Jupiter-Saturn aspect was in January 2009, correctly predicting the Great Recession. Mars-Jupiter-Saturn again formed an aspect with one another in August 2010. The market did reach a yearly low (9686 DJIA) the week ending July 2. March 2011 was the next alignment, which correlated with a severe market reversal in August dropping to 10,818, and briefly breaking this low the week ending September 23, before climbing right above 12,000 by the end of the year. There was another Mars-Jupiter-Saturn aspect peaking in July 2013 but this produced null effects. The next significant market downturn was expected near February 2017 triggered by Mars opposition Jupiter. This was realized the week ending November 4, 2016 with a short but sharp downturn. Another Mars/Jupiter conjunction in January 2018 produced an 11.6% drop in value that took several months to gain back.

A Jupiter/Saturn conjunction peaks 12/21/2020! Near March 2020 the planetary tidal forces will be at a maximum pushing the nation into a steep recession or depression (correct).

Mars and Jupiter signals another major market drop near July 2021.

(6) {} Short-term: Sun conjunction Mercury in Capricorn, especially if correlating with a conjunction or opposition involving Mars or Jupiter, indicates a sharp turn up in the market beginning 25 days before the Sun/Mercury conjunction.

Previously, the Sun/Mercury Capricorn conjunction of January 2020 correlated with a Sun/Jupiter conjunction! This resulted in a February 2020 high.

There is a Sun/Mercury conjunction on December 19, 2020 – expect a strong market rise. (correct)

There is no Sun/Mercury conjunction in Capricorn during 2021.

(7) {+} A high is indicated near April 2021.

{-} A low is indicated near September 2021.

The 36.49-month cycle in the stock market points to a high April 2021.

The 508-day cycle indicates a high in December 2020. (correct) The low for this cycle is pegged for early September.

The 8-month cycle signals a high in April or May and a low scheduled for early September. This supports the 36-month cycle.

The shorter 153-day cycle identifies a low in April and a high in September 2021 but it is largely being offset by the slower cycles.

(8) {-} Dry weather indicates a bear market, wet weather points to a bull market.

2007 was the third year of drier weather and the onset of the Great Recession. 2012 continued the short dry trend and was the driest year since 1988! The economy indeed struggled throughout 2012 although stocks regained much of their Great Recession loss. 2013 finally reversed the drop in precipitation (don’t try to tell that to Californians) with an average gain throughout the U.S. of 1.12 inches. Drier conditions in 2014 stalled but did not stop the gradual market rally.

2015 was dramatically wetter than 2014. 2015 was the wettest year since 1983! The stock market hit an all time high ending May 29, 2015 (19,019) in testimony to wet 2015. 2016 turned drier but precipitation was still above average. The market surge above 20,000 for the first time in January 2017 is a sign of even higher prices ahead.

Higher prices did indeed unfold in 2017 – another above average wet year. 2018 was another wet year and the market did gain over 10% by September before tumbling. Based on the Jupiter/Neptune aspect, it should turn dry again in 2020 (correct). Drier 2020 correlated with the major stock market drop beginning in March and the badly damaged economy due to the pandemic. The drier conditions are a precursor for another sell-off during 2021.

(9) {-} There are transiting planet cycles to the U.S. chart that have repeatedly correlated with recessions and panics. The greatest economic downturns tend to be when the slow transits (21-year Uranus, 41-year Neptune, or 62-year Pluto) are formed to certain planets or angles in the U.S. natal chart.

Transits to the U.S. chart confirm previous indicators for a market rise into April with trouble coming in August/September.

Transiting Pluto completes the third phase opposition to natal Mercury in the U.S. horoscope on New Year’s Day, a sign of vigorous commercial activity coming to fruition. Neptune makes a square to Mars March 30 – a stimulating time for the market. Transiting Neptune is in opposition with natal Neptune peaking in May and August (retrograde) and once again in early 2022. The oil industry will be under pressure and a sense of uncertainty will hover over the nation. This does not sit well with Wall Street. Neptune retrograde to natal Mars peaks September 29 possibly signaling investment hesitation.

(10){} The Mars/Pluto conjunction roughly every two years correlates with a top and a rapid market drop off 75% of the time. The April 26, 2018 conjunction corresponded with the January high and March sell-off. The next conjunction is March 23, 2020! (correct)

Recent Posts

- Amendment 14 and the China Crisis

- Precipitation Trends 2023-24

- Temperature Trends 2023-24

- National Forecast 2024

- Financial Forecast 2024

Categories

Pages

- Home

- Books

- Home

- Newsletters

- 2020 Triple Alignment

- Black Holes

- I Heard It Through the Grapevine

- Jupiter-Saturn Star Comments

- Jupiter/Pluto 2020: The Great Transition

- Jupiter/Saturn Conjunction 12/21/2020

- More Donald Trump Drama

- More Earthquakes in 2018-2023

- Progressive Policies and the Uranus/Pluto Cycle

- The Star of Impeachment

- Services

- Testimonials

- Videos

- Your Astrologer

Please send me more information….