Oil Money and War

- Bill Hansen

- on Jul, 28, 2022

- No Comments.

OIL MONEY AND WAR

Oil is a factor in world economic and political stability. As oil prices increase so do most finished goods. Stock markets and the general world economy are sensitive to fluctuating oil prices. Considering that many of the principal exporters of crude oil – Saudi Arabia, Russia, Norway, Venezuela, Iran, UAE, Nigeria, and Kuwait – are in unstable regions, a world oil crisis due to manipulation (domination) of the price of crude, war, or the shortage of supply creates a serious disruption in price stability and resulting social unrest.

It was not long ago that serious debate revolved around the end of oil, not ending oil as the premier energy source but running out. Saudi Arabia holds the greatest reserves but its exact capacity is unknown. The so-called Golden Triangle where most of the country’s oil pumping and refining facilities are located is old. New oil fields have not been explored. China’s insatiable appetite for oil and other raw goods could outstrip this resource reasoning went. Then fracking arrived allowing for better extraction from existing fields resulting in a rebounding of American reserves and production capability during the Trump administration. Joe Biden’s presidency reversed American oil independence with prohibitions on new drilling on public land, tightening environmental regulations, and cancelation of the Keystone KL pipeline from Canada. Democrat leadership decided it was time to jump-start solar, wind and battery power initiatives that are less polluting than petroleum. With a turn toward renewable energies, talk has switched from oil depletion toward sustainability. An alternative energy policy was inevitable it seems, not to avert the looming oil shortage, but to help cleanse the climate.

The move toward alternative energy will increase in the years ahead. And it should from sustainability and less polluting point of view. But alternative energy alone cannot supply all the energy that is needed, that is why nuclear energy and fossil fuels will continue to play an important role in energy production. Fuel oil will be with us for a long time. Petroleum products are ubiquitous. Even though the auto industry is gearing up for mostly electric and hybrid vehicles, there are billions of small engines and motors in need of gasoline. Renewable energy sources and the hydrogen engine will eventually replace oil as the number one energy resource but not anytime soon.

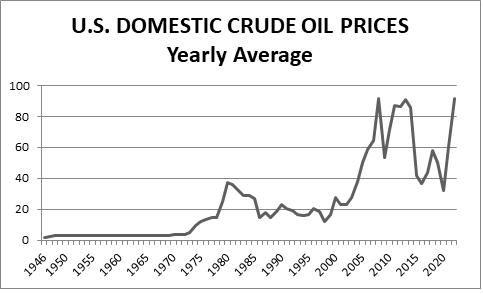

Steep gasoline price hikes are nothing new. The build-up to the Vietnam War in late 1965 triggered two price rises. An even longer and much more severe run up occurred during the Gulf oil crisis when gas shortages took place in 1974. OPEC nations raised the price per barrel of crude, and while motorists waited in line for a fill-up, the government was busy printing ration cards. Luckily, the crisis ended before drastic measures were enacted. A benefit of the oil embargo was expansion of the emergency oil reserves. Another benefit that resulted from the crisis was production of more fuel-efficient automobiles and an oil exploration drive.

Most oil experts agree that oil is either at or near peak levels; this means that finding and extracting crude will become more and more expensive. So much of the economy revolves around oil – from vehicle manufacture and repair to petroleum based products. Oil, therefore, is a leading indicator of the economic health of a nation. Oil as a nonrenewable resource has skyrocketed in price and prestige. Oil rich nations less than a lifetime ago were mostly nomadic and destitute; they are now lavish oases of everything that money can buy. Since oil is a commodity worth fighting over, it should also be worth forecasting.

War and political instability have a direct bearing on the price of oil in high production or transportation hubs. The Yom Kippur War 1974, Iranian Revolution 1979, Iran-Iraq War 1980, the First Gulf War 1990, the Second Persian Gulf War 2003, the Iraq Civil War and ISIS 2011-2017, and most recently the Russian Ukraine War 2022 all correlated with rapidly rising oil prices.

Edward Dewey, a cycle’s analyst associated with The Foundation for the Study of Cycles, isolated an 8-year cycle in Standard Oil Company sales in the early 1950s. He found evidence for a 42-month and 6-year cycle, but an 8-year period is especially significant. I found a planetary connection to Dewey’s 8-year rhythm in oil prices. Saturn orbits the Sun in 29.5-years. If this orbit is divided into four segments beginning at its perihelion (closest point to the Sun), it then takes Saturn about 6.64-years to square or make a 90-degree angle with its perihelion point. In another 7.34-years Saturn reaches aphelion – its furthest point from the Sun. From aphelion to 90-degrees from perihelion takes 8.13-years. 7.43-years later, perihelion is reached again. At each of these points, gasoline prices have jumped in value!

Saturn was square its perihelion in March 1967. Gasoline prices peaked in September at 23 cents a gallon.

The Saturn perihelion took place January 1974. Prices were the highest they had ever been in August of that year.

Saturn squared its perihelion February 1981. Gasoline prices hit $1.38 a gallon in March. This is the highest price gas had ever been.

Saturn was aphelion in September 1988 and gas prices soared in 1989.

Saturn was perihelion in July 2003 and gas prices rose, especially during the winter months. They reached a peak of over $2 a gallon in 2004.

One might ask, why should Saturn correlate with higher gasoline prices? Astrologers have for centuries considered Saturn the planet of restriction, loss, depletion, limitation, denial, and inadequacy. Oil is certainly a limited resource. Any squeeze in the availability of petroleum ratchets up price, especially when demand is high. The good news is that any restriction in the supply or distribution of refined oil does not last forever. What goes up must come down.

There was a huge price increase right before Saturn square perihelion in 2010. The peak in prices came in 2008.

Saturn is aphelion April 17, 2018 during the Iraq Civil War and coalition against ISIS. Prices peaked in 2013.

Saturn is square its perihelion in 2026. Beginning in 2022 fuel prices increased exponentially similar to the extraordinary run-up around 2008 and 2013. The Covid-19 pandemic of 2020 created supply chain issues plus the government infused trillions of dollars into the economy fueling inflation. The Russian invasion of Ukraine in 2022 further disrupted oil supplies and restricted purchases from Russia caused rapid worldwide price increases.

Future spikes in oil prices are likely during the time periods below:

Saturn is perihelion November 28, 2032.

Saturn is square its perihelion in 2039.

Saturn is aphelion July 15, 2047.

Recent Posts

- Amendment 14 and the China Crisis

- Precipitation Trends 2023-24

- Temperature Trends 2023-24

- National Forecast 2024

- Financial Forecast 2024

Categories

Pages

- Home

- Books

- Home

- Newsletters

- 2020 Triple Alignment

- Black Holes

- I Heard It Through the Grapevine

- Jupiter-Saturn Star Comments

- Jupiter/Pluto 2020: The Great Transition

- Jupiter/Saturn Conjunction 12/21/2020

- More Donald Trump Drama

- More Earthquakes in 2018-2023

- Progressive Policies and the Uranus/Pluto Cycle

- The Star of Impeachment

- Services

- Testimonials

- Videos

- Your Astrologer